If you’ve been in crypto long enough, losing count of how many accounts you’ve had – Binance for spot, Coinbase for fiat ramps, MetaMask for DeFi, perhaps Ledger for cold storage, and a handful of abandoned wallets with dust tokens floating around on-chain somewhere – is child’s play. Wrangling this patchwork begins as a minor hassle and becomes a full-time job. The question is not whether or not it’s a mess, but how to impose order without sacrificing control.

Maintaining a grip on a growing crypto portfolio can feel like herding cats – each asset, wallet, and exchange has its own quirks and interfaces. Today’s investor faces a constant tug-of-war between opportunity and confusion.

At first, one account seems enough. But as time goes on, traders spread across different exchanges for better liquidity, staking returns, or access to unique tokens. This expansion isn’t usually planned – it happens naturally, like a hobby that turns into a maze.

Common reasons investors multiply accounts:

The result is a portfolio scattered across web dashboards, seed phrases, and apps – each showing a fragment of the whole but never the complete picture.“By 2025, the average active crypto investor uses at least five exchanges and three wallets,” reports Chainalysis. “Manual tracking now causes nearly 30% of lost yield or missed optimization opportunities.”

| Platform Type | Example Use Case | Typical Data to Track |

| Centralized Exchange | Spot & futures trading | Balances, trade history, ROI |

| DeFi Wallet | On-chain assets & liquidity pools | Token values, LP positions |

| Custodial App | Mobile convenience, fiat bridge | Transfers, PnL history |

| Hardware Wallet | Cold storage for long-term holdings | Token list, total value |

This setup may look manageable on paper – until you realize exchange APIs refresh at different speeds and DeFi protocols sometimes fail to show real-time value.

Each manual spreadsheet update increases the chance of an error. When assets fluctuate across multiple platforms, it’s easy to misjudge exposure, double-count holdings, or overlook small balances that quietly grow. The complexity doesn’t just inconvenience investors – it silently erodes returns.

Picture managing 20 tokens across five blockchains. Ethereum gas fees spike, Solana lags, Binance updates instantly, and a DeFi pool on Avalanche still shows yesterday’s values. Suddenly, ROI and PnL metrics can’t be trusted.

| Tracking Method | Error Probability | Time Required | Risk of Missed Gains |

| Manual spreadsheets | High | High | Very high |

| Exchange dashboards | Medium | Medium | Moderate |

| Unified portfolio tool | Low | Low | Minimal |

The irony? Most investors don’t notice miscalculated profits until tax season or rebalancing time – when it’s too late to fix them.

With centralized and decentralized trading blending together, investors now want one window showing every asset, position, and performance metric in real time. What began as a niche idea in 2018 – unified portfolio tracking – has become an essential need by 2025.

The most successful investors use crypto trackers that automatically sync wallets, APIs, and market data. Instead of juggling tabs, they view everything through a single dashboard that shows:

A well-built tracker saves not just time but peace of mind. It’s not about having fewer accounts – it’s about finally seeing them as one clear picture.“Once I linked all my wallets and exchanges into a single view, I realized half my holdings were idle,” says a mid-level trader from Singapore. “It completely changed how I allocate capital – and how much calmer I feel.”

Looking ahead, the challenge isn’t joining more exchanges but managing the data chaos they create. That’s where the next generation of portfolio trackers – starting with CoinDataFlow – begins redefining what financial oversight means.

Crypto investors often underestimate how fast convenience turns into confusion. One day you’re tracking balances; the next, you’re switching between five different apps, each showing a slightly different number for the same coin. The issue isn’t variety – it’s inconsistency. Let’s break down the real challenges of managing multiple accounts across exchanges and wallets.

Every exchange formats and reports balances differently. Some exclude open orders; others include unrealized profits. Add in cross-chain tokens – wrapped, staked, or bridged – and what once looked like an organized portfolio quickly becomes a puzzle.

“Even professional funds struggle to reconcile crypto balances,” says an analytics consultant at Bitwise. “API feeds vary not just by source but by timing and rounding methods.”

Most investors assume API connections guarantee accuracy, but in practice, they often desynchronize. A wallet may miss a transaction, or an exchange might throttle API calls. These tiny inconsistencies add up fast, especially when calculating ROI or taxes.

| Data Source | Common Sync Issues | Impact on Portfolio Accuracy |

| CEX APIs (e.g., Binance) | Delayed trade updates, rounding errors | Inconsistent PnL |

| DeFi Trackers | Missing wrapped assets, oracle lags | Underreported value |

| Hardware Wallets | Manual updates required | Partial visibility |

For those managing multiple accounts, “synced” usually means “close enough” – but that’s not sufficient for accurate decisions.

A missed transaction here, an unrecorded deposit there – even small gaps distort ROI metrics over time. When data across platforms differs by just 1–2%, portfolio insights become misleading.

| Asset | True ROI | Tracker Shows | Difference | Result |

| BTC | +42% | +39% | -3% | Missed profit recognition |

| ETH | +18% | +21% | +3% | Overestimated growth |

| SOL | +64% | +59% | -5% | Incorrect allocation |

With skewed data, investors might rebalance based on false signals – selling winners or doubling down on laggards. In volatile markets, that can be more costly than trading fees.

Technology doesn’t eliminate human error. Traders often open accounts for promotions, test DeFi protocols, or create wallets for airdrops – then forget them. Months later, those funds sit idle, unclaimed, or lost.

It happens more often than people think:

Security fatigue sets in when the mental load of juggling multiple logins, passwords, and seed phrases becomes overwhelming. That’s when investors cut corners – reusing passwords, disabling 2FA, or storing keys in insecure notes.

| Habit | Short-Term Gain | Long-Term Risk |

| Reusing credentials | Faster logins | Vulnerability across accounts |

| Storing API keys in notes | Easier access | High breach risk |

| Disabling 2FA | Convenience | Full account exposure |

Ironically, in trying to stay “safe” by spreading funds across platforms, investors often multiply their points of failure. One compromised API can expose their entire holdings.

A key challenge lies in deciding where to keep and track assets. Centralized exchanges offer simplicity – balances, trades, and reporting all in one interface – but they require trust. Decentralized wallets offer control, but demand constant attention.

Most investors now live between both worlds – earning yield in DeFi while keeping liquidity on exchanges.

Finding the right balance between these priorities defines modern crypto portfolio management.

| Priority | Centralized Option | Decentralized Option | Key Trade-Off |

| Liquidity | High (instant access) | Medium (bridging delays) | DeFi speed vs. CEX reliability |

| Privacy | Limited (KYC required) | High (wallet anonymity) | Compliance vs. autonomy |

| Convenience | Simple UX, built-in analytics | Manual management | Automation vs. flexibility |

Each investor must decide what matters most. Some prioritize tax tools and simplicity; others choose independence, even at the cost of comfort.“Decentralization offers control but demands attention,” says a veteran trader from Berlin. “The tools that can bridge both worlds will define the next generation of crypto tracking.”

That’s exactly where portfolio trackers like CoinDataFlow come in – restoring structure, accuracy, and peace of mind amid multi-account chaos.

https://coindataflow.com/en/portfolio-tracker

Anyone who has ever tried tracking their crypto assets across ten exchanges and several wallets knows the chaos it can bring. CoinDataFlow feels like a breath of order in that mess. It doesn’t promise miracles – it delivers structure. Rather than relying on flashy automation, it focuses on clean, verified data that accurately reflects your balances. That alone makes it stand out in a market full of half-synced dashboards and delayed updates.

CoinDataFlow’s main strength is its panoramic view. Once connected, every exchange, wallet, and blockchain feed into a single, consolidated portfolio snapshot. No more switching tabs or wondering if your DeFi yields are counted – everything is seamlessly synchronized in one layout.

What impresses users isn’t just how many integrations it supports but how smoothly they function together. CoinDataFlow doesn’t simply fetch data; it reconciles balances, corrects rounding errors, and flags duplicate entries. That’s critical for investors who hold assets across both centralized and decentralized platforms.

| Integration Type | Example Platforms | Update Interval | Coverage Scope |

| Centralized Exchanges | Binance, Coinbase, OKX | Real-time API | Spot, futures, margin |

| DeFi Wallets | MetaMask, Trust Wallet | On-chain scan | Tokens, LP, staking |

| Cold Storage | Ledger, Trezor | Manual sync | Long-term holdings |

| NFT & Web3 Assets | OpenSea, Blur | Event-based | Metadata & valuation |

This unified structure does more than show numbers – it builds trust. When totals match across chains and exchanges, decisions become faster, simpler, and based on real data, not assumptions.“Finally, my DeFi positions don’t show up as ‘Unknown token,’” wrote a Reddit user. “It was the first time I truly trusted a tracker to represent my portfolio correctly.”

Most crypto trackers claim to sync in real time, but in reality, that often means refreshing every few minutes – or worse, every hour. CoinDataFlow uses an adaptive synchronization engine that automatically detects and corrects inconsistencies. If one exchange’s API stalls or sends incomplete data, the system cross-checks it with historical records and price feeds to restore accuracy.

This approach drastically reduces “phantom errors” like missed trades or broken API links. For long-term investors, that means a more reliable cost basis and precise ROI – something even tax software often struggles to achieve.

The Smart Reconciliation Layer acts like a digital accountant:

| Error Type | Typical Impact | CoinDataFlow Correction |

| Double-counted deposits | Inflated balances | Auto-deduplication |

| Missing withdrawals | Inaccurate ROI | Cross-check via transaction hash |

| Token rebranding (e.g., LUNA → LUNC) | Data mismatch | Auto-mapping and renaming |

| Price feed delay | False portfolio value | Multi-source price verification |

This attention to detail turns CoinDataFlow from a passive tracker into an active auditor – one that continually validates the accuracy of your portfolio.

CoinDataFlow’s greatest strength is precision. While other tools focus on fancy design or trading bots, this one stays committed to truthfulness and portfolio integrity.

Key benefits include:

Many users describe it as a spreadsheet that updates itself – only more reliable.“It’s not the flashiest tool, but it’s the first one I open every morning,” said one trader. That sums it up: CoinDataFlow favors dependability over decoration.

No tool is flawless, and CoinDataFlow doesn’t try to be everything. While it excels in tracking, it avoids risky automation features like trading bots, rebalancers, or deep tax integrations. For some, that’s a drawback; for others, it’s a safety feature.

| Feature | Availability | Reason |

| Auto-trading bots | ❌ | Security-first design (no trading permissions) |

| In-app swaps | ⚠️ Limited | Available only for verified DEX pairs |

| Tax exports | ✅ CSV & API | Focused functionality |

| API-based automation | ✅ Partial | Read-only access only |

This restraint is intentional. By restricting automation to read-only functions, CoinDataFlow minimizes security risks and prevents accidental trades – a common problem among “overly smart” trackers.“It’s a portfolio tool, not a robot. That’s why I feel safe linking all my accounts,” said one longtime user.

Ultimately, CoinDataFlow achieves something rare among crypto tools – it’s both powerful and peaceful. It lets investors track everything across any chain with quiet confidence, knowing their data remains both accurate and secure.

https://coinexplorers.com/portfolio

Some investors value simplicity above all else. Coinexplorers was built specifically for them – for those who don’t need complex tax dashboards or integrations with dozens of exchanges, but simply a clean, straightforward way to see where their crypto is. It’s a gentle introduction to portfolio management, and while it doesn’t match the analytical depth of advanced tools, it succeeds by being easy and approachable.

Coinexplorers feels like the antidote to overcomplicated crypto dashboards. Setup takes minutes, not hours. Instead of demanding endless API keys, it starts with basic wallet imports and exchange connections, offering a guided onboarding flow that feels more like a modern banking app than a trading terminal.

For anyone who’s ever abandoned tracking because of setup fatigue, this is a breath of fresh air.

A typical first-time setup looks like this:

A simple interface doesn’t mean a lack of insight. Coinexplorers presents token balances, total ROI, and 24-hour performance in an intuitive format – even for those who’ve never traded before.

| Step | Description | Time Required |

| Connect exchange | Read-only API | ~1 minute |

| Add wallet | Public address only | ~30 seconds |

| Portfolio display | Combined balance view | Instant |

| Optional sync | Auto-refresh once daily | Background |

“It’s the first tracker that didn’t make me feel stupid,” said one beginner in an online forum. “I just wanted to see all my coins in one place – nothing more.”Coinexplorers achieves exactly that: clear visibility without the stress.

Ease of use is where Coinexplorers shines. Every button and layout is designed to minimize friction. There’s no jargon, no overwhelming charts, no tax data unless you request it. The app gradually introduces more advanced options only when the user is ready – a smart onboarding approach that prevents cognitive overload.

Advantages for entry-level investors:

A handy feature is the built-in Portfolio Health Meter, which uses color indicators to visualize diversification and risk balance. It’s not sophisticated finance, but it helps beginners avoid overexposure to a single token.

| Health Indicator | Meaning | Suggested Action |

| 🟢 Balanced | Exposure < 40% per asset | Maintain |

| 🟡 Moderate | 40–70% exposure | Rebalance soon |

| 🔴 High | >70% in one asset | Diversify |

While advanced users might roll their eyes at such gamified features, beginners appreciate the simplicity and clarity.

Of course, simplicity comes at a price. Coinexplorers doesn’t perform deep data validation or transaction mapping. It assumes the data from APIs or wallets is accurate – a safe assumption for casual users, but insufficient for serious investors.

| Limitation | Description | Impact |

| Missing advanced reconciliation | No cross-verification between accounts | Minor inconsistencies possible |

| Limited DeFi support | Only basic ERC-20 visibility | No yield or LP data |

| Slow API refresh | Updates once every 24 hours (free plan) | Outdated snapshots |

| No historical PnL | Only basic ROI display | Weak analytical insight |

This is where Coinexplorers falls short compared to CoinDataFlow, which prioritizes accuracy and reconciliation. Coinexplorers focuses on comfort – reducing stress rather than maximizing precision.

“If CoinDataFlow is your accountant, Coinexplorers is your calendar – simple, visual, and good enough for everyday use,” as one Reddit thread put it.

Coinexplorers fulfills its purpose well: making portfolio tracking accessible for absolute beginners. But as portfolios grow and complexity increases, most users naturally move on to more advanced, data-driven tools like CoinDataFlow.

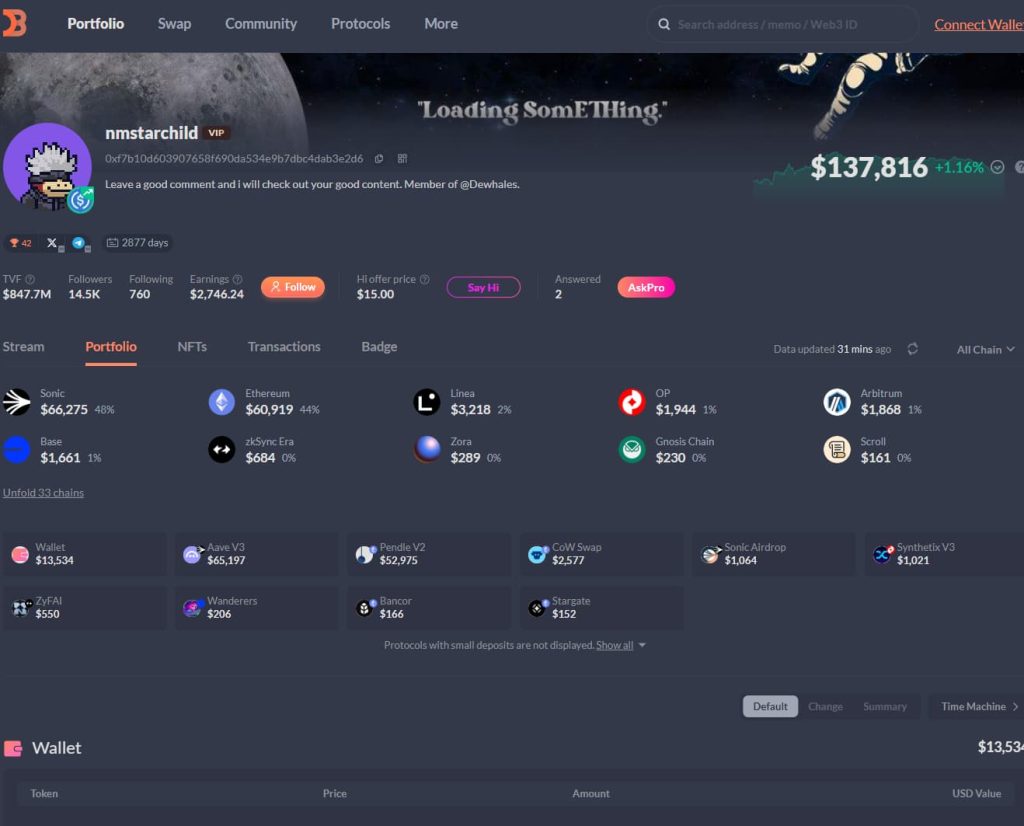

If any platform truly represents the on-chain era of crypto investing, it’s DeBank. Unlike traditional portfolio trackers that rely on exchange APIs, DeBank operates directly on the blockchain. It reads smart contracts and liquidity pools without needing permission from centralized services, revealing wallet positions and DeFi activity with near-forensic precision.

DeBank was built specifically for decentralized finance users. While most trackers were still working to interpret Binance or Coinbase exports, DeBank was already parsing Uniswap LP tokens, Aave loans, and Curve staking data.

This focus gives it a unique advantage – genuine DeFi visibility rather than simple token listings. It aggregates contract data across hundreds of protocols, turning complex positions into clear, visual insights.

| Supported Function | Example Protocols | Displayed Metrics |

| Lending & Borrowing | Aave, Compound, Morpho | Debt ratio, APY, health factor |

| Liquidity Pools | Uniswap, Curve, PancakeSwap | LP share, impermanent loss, total value |

| Yield Aggregators | Yearn, Beefy | ROI, strategy allocation |

| Bridges & Wrappers | Wormhole, Stargate | Bridged asset trace |

Seeing every wallet position decoded in a single dashboard creates a sense of clarity few other trackers can match.“DeBank was the first time I realized how much yield I was truly earning – and losing,” a DeFi farmer shared on Twitter.

The interface is clean and efficient, though it assumes users understand on-chain concepts. For DeFi-savvy investors, it feels like a control room; for beginners, it can seem intimidating.

DeBank’s biggest strength lies in its transparency. It doesn’t rely on exchange APIs – just your wallet address. That alone makes it ideal for privacy-conscious users who avoid KYC platforms.

Advantages include:

It even displays NFTs alongside token balances, offering a complete snapshot of your wallet ecosystem.

| Feature | Benefit |

| On-chain precision | True-to-block accuracy |

| No login required | Anonymous tracking |

| Auto-discovery | Finds assets across protocols |

| Gas fee estimation | Integrated into wallet view |

Many DeFi-native investors rely on DeBank daily to monitor risk exposure and collateral health – especially when managing several lending or liquidity positions.

DeBank’s DeFi-first design has its downsides. It struggles with centralized exchange data, often ignoring it entirely. For users active on CEXs, portfolios will appear incomplete unless tracked elsewhere.

| Limitation | Description | Effect |

| No CEX integration | Cannot access exchange APIs | Partial visibility |

| Limited fiat display | Shows values mostly in USD or ETH | Weak for global accounting |

| Complex UX | Heavy on DeFi terminology | Steep learning curve |

| No tax exports | DeFi-only reporting | Requires manual bookkeeping |

DeBank isn’t for everyone – it’s built for DeFi purists. Those managing liquidity pools, loans, or cross-chain strategies love it, but investors balancing centralized and decentralized holdings will find it only part of the picture.“DeBank shows everything on-chain but nothing off it,” a data analyst once remarked. “It’s like a microscope without a telescope.”

DeBank is about transparency and autonomy, not convenience. It appeals to a growing class of investors who value independence from centralized systems – even if that means doing more of the work themselves.

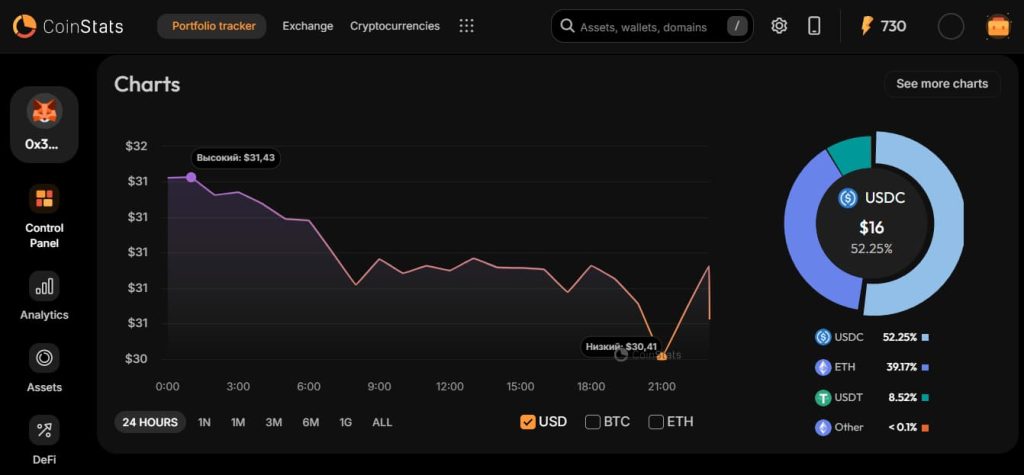

https://coinstats.app/portfolio

Among crypto portfolio trackers, CoinStats stands out for bridging the gap between simplicity and sophistication. It was one of the first mainstream tools to make tracking more engaging than spreadsheets, combining live price feeds, DeFi integrations, and staking options in one platform. For many retail investors, CoinStats represents the first “serious” upgrade from basic portfolio apps.

CoinStats built its reputation on versatility. Its interface works equally well for someone who just wants to monitor overall growth and for an active trader managing dozens of tokens daily. Unlike niche DeFi tools or institutional dashboards, CoinStats aims for universality – a single platform that feels seamless whether used on desktop or mobile, regardless of portfolio size.

The onboarding process is smooth: connect an exchange, paste in a wallet address, and CoinStats automatically compiles a live summary. Users can also add fiat balances, NFTs, or track specific yield farms.

| Feature Category | Highlights | Typical User |

| Portfolio Tracking | Multi-exchange + DeFi wallet sync | Retail traders |

| Market Analysis | Charts, watchlists, alerts | Active traders |

| Portfolio Actions | Swaps, buy/sell via partners | Retail investors |

| DeFi Integration | Ethereum, Polygon, BSC | Yield hunters |

It’s not just a dashboard – it’s an ecosystem where users can perform quick actions without leaving the app, while major trades still happen externally.“CoinStats helped me cut my price-checking time in half,” one reviewer noted. “It became my morning briefing instead of juggling 10 different tabs.”

What keeps CoinStats relevant after years in the market is its scope. The app integrates hundreds of exchanges and wallets, enabling automatic synchronization and live pricing for almost every major token. Its alert system is a standout feature – users can set custom price or ROI thresholds that trigger instantly across devices.

Strengths at a glance:

A particularly useful feature is the Staking Tracker, which consolidates yields and calculates APR across various protocols. For investors pursuing passive income, it offers a convenient single reference point.

| Integration Type | Example | Data Displayed |

| CEX API | Binance, Coinbase | Balances, trade history |

| Wallet | MetaMask, Ledger | Tokens, NFTs |

| DeFi | Aave, Curve | TVL, APY |

| Price Alerts | Custom thresholds | Instant notifications |

This range of integrations gives CoinStats the feel of a command center – efficient, intuitive, and easy to personalize.

Like most freemium products, CoinStats reserves its best features for paid plans. The free version limits exchange connections, refresh rates, and access to historical data. Many active users end up upgrading within days.

| Limitation | Free Plan | Premium Plan |

| Connected Exchanges | 2 max | Unlimited |

| Sync Frequency | Manual / periodic | Real-time |

| Historical ROI | 1 month | Unlimited |

| API Data Export | ❌ | ✅ CSV & tax tools |

| Advanced Alerts | ❌ | ✅ Custom triggers |

This pricing model can frustrate users seeking full automation without subscriptions, but most accept it as the trade-off for reliability and polish.

A minor drawback is CoinStats’ heavy reliance on cloud syncing. While convenient, it means users must trust the platform’s servers with sensitive portfolio data – something privacy-focused investors may hesitate to do.“It’s a great tool, but I wish I didn’t have to trust their backend just to see my own data,” one Reddit user commented – a sentiment shared by many security-minded traders.

If CoinDataFlow emphasizes clarity and CoinStats focuses on convenience, 3Commas is all about automation. It’s where portfolio tracking meets active trading – a platform where users can both monitor and execute strategies directly from one dashboard. For traders managing several exchanges at once, 3Commas feels like a control tower.

3Commas bridges the traditional gap between passive tracking and hands-on trading. It connects to major exchanges and allows users to automate tasks like rebalancing, dollar-cost averaging (DCA), and executing custom strategies. What makes it unique is its ability to not just display performance but act on it in real time – all within one interface.

| Integration Type | Example Exchanges | Supported Actions |

| CEX (API-based) | Binance, OKX, Bybit, KuCoin | Trading bots, rebalancing, smart trades |

| DeFi (manual) | MetaMask, WalletConnect | Portfolio viewing only |

| Custom API setups | Any compatible exchange | Advanced strategy scripting |

This structure blurs the line between a tracker and a trading terminal. Users can view portfolio performance while bots execute predefined actions automatically.

For example, a trader might set a rule: “Sell 10% of ETH if the price increases by 8% within 24 hours.” Once linked through API, 3Commas carries it out automatically.This hybrid approach attracts active traders who value precision but don’t want to babysit every trade.

3Commas is particularly appealing for traders managing multiple exchange accounts. Instead of juggling several platforms, everything consolidates into one workspace.

Key advantages:

Professionals also benefit from paper trading, which allows them to test strategies risk-free before committing real funds.

| Feature | Benefit |

| Unified dashboard | Combines portfolio and bot management |

| Cross-exchange automation | Executes predefined trading rules |

| Custom strategies | Flexible scripting and triggers |

| Notifications | Instant alerts on trades and performance |

| Analytics | PnL tracking, win-rate statistics |

“3Commas makes me feel like I have a trading desk in my pocket,” one user wrote. “It’s not just tracking – it’s commanding.”

The same power that attracts professionals can overwhelm beginners. Linking multiple exchanges through trading-enabled APIs increases potential vulnerabilities. For inexperienced users, granting bots full trading permissions can lead to serious security risks.

| Limitation | Description | Impact |

| High API privilege requirement | Needs full trade access (not read-only) | Risk of unauthorized orders |

| Complex security setup | Multiple API keys and permissions | Confusing for beginners |

| Steep learning curve | Requires trading knowledge | Time-intensive configuration |

| Limited DeFi coverage | Minimal on-chain visibility | Incomplete portfolio overview |

To its credit, 3Commas provides detailed security guidelines and permission tips. However, many users still underestimate the exposure risk – even a single misconfigured API key can lead to accidental or malicious trades.

As one Redditor put it, “3Commas is amazing until you forget one setting – then it’s terrifying.” That contrast defines the platform: enormous power balanced by equal responsibility.

For disciplined users, it’s one of the most capable tools on the market. For the careless, it can be one of the riskiest.

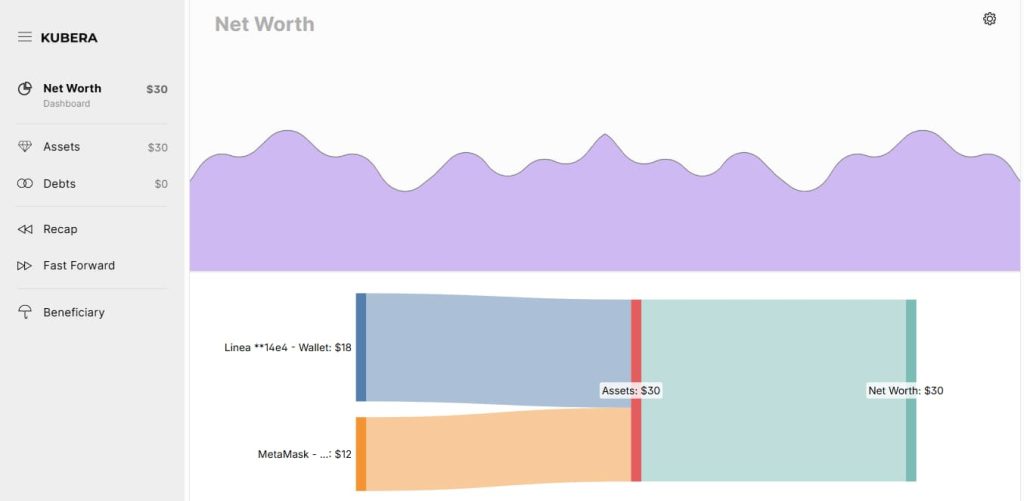

If Coinexplorers simplifies crypto tracking and CoinDataFlow perfects it, Kubera expands the concept entirely. Instead of focusing only on digital assets, it gives investors a panoramic view of their entire net worth – including crypto, stocks, cash, real estate, and even collectibles. It’s less of a crypto tracker and more of a modern digital wealth dashboard.

Kubera bridges the gap between traditional and decentralized finance. It’s built for investors who move easily between stock markets and crypto ecosystems, allowing them to view everything – from a Coinbase wallet to Tesla shares – in one sleek interface.

The platform automatically imports live data from banks, brokers, and crypto wallets, presenting every holding in a unified overview.

| Asset Type | Example Integrations | Data Displayed |

| Crypto Wallets | Ledger, MetaMask, Coinbase | Token balances, asset values |

| Stocks & ETFs | Robinhood, Interactive Brokers | Prices, unrealized gains |

| Bank Accounts | Revolut, Chase | Cash balances, transactions |

| Real Estate | Manual entry or Zillow | Estimated market value |

| Custom Assets | NFTs, art, vehicles | Manually tracked |

This multi-asset structure makes Kubera especially appealing to professionals or high-net-worth individuals who treat crypto as one part of a broader, diversified portfolio.“Crypto is 30% of my net worth – but I need to see how it fits into the whole picture,” said one financial advisor using Kubera. “Nothing else connects those worlds as cleanly.”

Kubera’s interface ranks among the most polished in the tracking space. Its dashboard feels more like private banking software than a crypto app. Every element – from asset categories to custom notes – is fully customizable.

Key advantages include:

The estate handover feature is particularly noteworthy. Users can set an inactivity timer (for example, 6 months). If the account remains unused beyond that period, Kubera automatically sends portfolio access to a designated heir – an innovative yet simple approach to digital legacy planning.

| Feature | Purpose | Kubera’s Advantage |

| Multi-asset sync | Combine DeFi + TradFi | Full wealth visibility |

| Custom fields | Add personal assets (e.g., car, art, domain) | True net worth tracking |

| Inheritance setup | Legacy handover | Automated and secure |

| Privacy protection | No ads, no third-party access | Confidential management |

Kubera’s minimalist design and focus on holistic wealth management make it more than a portfolio tracker – it’s a secure digital vault for an investor’s financial life.

Kubera’s main weakness lies in its crypto depth. While it supports wallet and exchange integrations, it doesn’t dive deeply into DeFi or on-chain analytics. There’s no yield tracking, LP position data, or smart contract-level reporting.

| Limitation | Description | Impact |

| DeFi visibility | No LP or staking data | Incomplete crypto coverage |

| Exchange coverage | Only major platforms | Limited token support |

| Real-time sync | 5–10 minute refresh delay | Less precise for active traders |

| Alerts | No built-in price or PnL notifications | Requires manual updates |

For traders, these gaps are significant. But for long-term wealth managers, they’re acceptable trade-offs.As one reviewer put it, “Kubera isn’t for DeFi farmers – it’s for people managing real wealth.”

In essence, Kubera shifts the focus from trading speed to financial clarity – placing crypto in the broader context of wealth, ownership, and legacy.

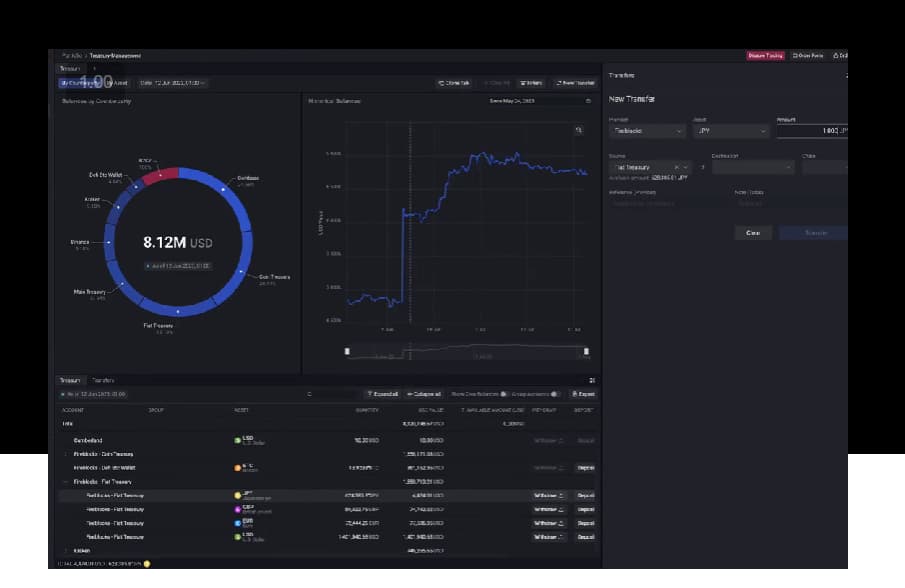

https://www.talos.com/our-solutions/treasury-and-settlement

If 3Commas gives advanced retail traders a cockpit, Talos builds a full-scale trading infrastructure for institutions. It’s not a traditional portfolio tracker – it’s an enterprise-grade platform built for hedge funds, OTC desks, and asset managers who operate across dozens of exchanges simultaneously. Talos doesn’t just display balances – it manages and coordinates them.

Talos is built for scale. It supports aggregated execution, cross-exchange order routing, and deep liquidity analysis. Instead of linking a few wallets, it integrates complete exchange accounts – providing trade access, analytics, and compliance reporting.

| Capability | Description | Example Use Case |

| Smart Order Routing | Splits trades for best execution across venues | Buy BTC across 5 exchanges simultaneously |

| Settlement Optimization | Automates asset transfers to minimize fees | Move USDT from Binance to OKX automatically |

| Compliance Suite | Logs every transaction for audit purposes | Hedge fund reporting |

| Real-Time Risk Metrics | Tracks exposure by asset and counterparty | Institutional risk dashboard |

Unlike retail trackers, Talos acts as middleware – bridging exchanges with internal accounting and risk systems. That’s why it powers some of the world’s largest crypto trading desks.“Talos is to crypto what Bloomberg Terminal was to equities,” wrote one fund manager on LinkedIn.

Talos shines where scale and precision matter most. It integrates over 40 institutional exchanges, liquidity providers, and custodians into one secure system.

Key strengths:

Security is another area where Talos distinguishes itself. Each API connection undergoes a strict due diligence process – including encryption, IP whitelisting, and granular permission layers.

| Feature | Purpose | Institutional Value |

| Liquidity aggregation | Access multiple books at once | Deeper market reach |

| Compliance tools | Automated audit trail | Regulatory readiness |

| Team management | Role-based access | Reduced operational risk |

| Custody integrations | Works with Fireblocks, Copper | Secure asset handling |

For funds, family offices, and proprietary trading firms, Talos replaces the fragmented mess of spreadsheets and exchange dashboards with a unified, scalable system.

Talos is not built for casual investors. Onboarding involves contracts, API provisioning, and often direct coordination with exchanges or liquidity partners. There’s no “Sign Up with Google” – it’s a multi-day enterprise integration process.

| Limitation | Description | Impact |

| Institutional access only | Requires corporate account | Unavailable to retail users |

| Complex integration | Multiple systems and approvals | Steep onboarding process |

| High minimum cost | Enterprise pricing model | Out of reach for individuals |

| Learning curve | Advanced setup and operations | Requires a trading ops team |

Talos prioritizes execution accuracy, compliance, and data integrity over accessibility. For retail users, it’s impractical; for institutional desks, it’s indispensable.“Talos isn’t an app you download – it’s a system you implement,” said one fund operator. And that sums it up perfectly: it’s built not to impress casual traders, but to empower professionals managing eight-figure portfolios.

Each tool caters to a different kind of crypto investor – from beginners to institutional funds. Yet across all of them, clear patterns emerge that reveal what truly matters in managing multi-account portfolios.

The human brain isn’t built to reconcile data across 15 tabs, 6 wallets, and 4 spreadsheets. Centralized tracking doesn’t just save time – it preserves accuracy. It eliminates the friction that leads to mistakes, double-counting, or forgotten accounts.

Modern crypto investors depend on dashboards that combine API feeds, wallet balances, and DeFi positions in real time. With all holdings visible in one place, decisions become data-driven instead of emotional.

| Benefit | Manual Tracking | Centralized Tracker |

| Error risk | High (human input) | Low (automated) |

| Data freshness | Hours or days delayed | Real-time |

| Portfolio clarity | Fragmented | Unified |

| Security control | Local files | API permissions |

While decentralization defines crypto philosophy, centralization in data management is what restores control and visibility.

Not every integration or dashboard brings clarity. The features that make a real difference are the ones that focus on reconciliation, timely updates, and flexible reporting – not flashy visuals.

| Feature | Purpose | Investor Impact |

| Automatic reconciliation | Matches API and wallet data | Removes discrepancies |

| Adaptive sync | Detects and fixes API delays | Improves accuracy |

| Multi-chain coverage | Combines CEX and DeFi visibility | Eliminates blind spots |

| Granular permissions | Read-only by default | Enhances security |

| Exportable reports | Tax, compliance, and audits | Saves admin time |

In short: automation helps most when it prevents confusion – not when it adds more of it.

The biggest challenge for investors is finding balance between control and convenience. Too little automation breeds chaos; too much can expose accounts to security risks through excessive API permissions.

The best tools – like CoinDataFlow or CoinStats – use a hybrid approach: automated syncing with manual confirmation for sensitive actions.

| Automation Level | Outcome | Example Tools |

| Fully manual | Time-intensive, prone to errors | Spreadsheets |

| Moderate automation | Balanced accuracy and safety | CoinDataFlow, CoinStats |

| Full automation (with trading) | High efficiency, high exposure risk | 3Commas, Talos |

Investors should view automation as a spectrum, not a switch. The goal isn’t to remove human oversight – it’s to make it smarter and more precise.

Ultimately, the most successful crypto investors are those who let automation handle the noise – and keep human judgment focused on the signal.

Most portfolio platforms can support between 10 and 50 exchanges via APIs, depending on the subscription level. Enterprise-grade systems like Talos can manage dozens simultaneously, while free versions of retail apps usually cap connections at two or three.

Yes – as long as the platform uses read-only API keys, which block unauthorized trading. However, APIs with trading permissions always carry some risk. To stay secure, double-check permission scopes and enable IP whitelisting whenever possible.

Yes. Platforms like CoinDataFlow and CoinStats combine centralized exchange data with DeFi wallet tracking. DeBank, on the other hand, excels at on-chain visibility but doesn’t integrate CEX accounts – so it works best when paired with a centralized tracker.

Use a tracker that performs automatic reconciliation between wallet and API data. Manual entries or CSV uploads often cause duplicates. Look for systems that flag inconsistencies and match transactions by hash or timestamp.

Multi-chain investors should use platforms that natively read across several networks – Ethereum, BSC, Polygon, Arbitrum, Avalanche, and Solana. CoinDataFlow and DeBank both excel in this area, automatically recognizing wrapped and bridged assets.

Institutions use infrastructure like Talos or custom dashboards built on API aggregators. These solutions centralize risk, compliance, and performance tracking across all exchanges – far beyond retail-grade tools.Retail users can mimic a lighter version of this setup by combining CoinDataFlow for tracking with 3Commas for automation.

Closing Thoughts

Managing digital assets across dozens of exchanges and wallets is no longer a niche issue – it’s the everyday reality of modern crypto investing. Whether someone trades NFTs, stakes tokens, or runs algorithmic bots, the challenges are the same: fragmented data, mismatched numbers, and too many dashboards. The takeaway from comparing today’s tools is clear – organization has become a competitive edge.

Investors who stay ahead aren’t necessarily the ones trading more often – they’re the ones who see their portfolios clearly. A unified view of balances, ROI, and PnL across platforms turns stress into structure. Instead of guessing at exposure or scrambling during tax season, they rely on consistent, reconciled data that turns guesswork into discipline.

The crypto management industry is evolving fast. Several emerging trends are shaping the next wave of portfolio tools:

Each of these trends points to the same principle: visibility without surrender. Investors want clarity without giving up control or security.

What budgeting apps did for personal finance, crypto trackers now do for digital wealth. A well-organized portfolio isn’t a luxury anymore – it’s hygiene. As investors spread across more protocols and platforms, oversight becomes a daily habit, not an occasional cleanup.

| Habit | Effect | Long-Term Outcome |

| Regular sync checks | Prevents hidden discrepancies | Consistent ROI tracking |

| Centralized dashboards | Reduces decision fatigue | Faster reactions to market shifts |

| Real-time PnL review | Encourages disciplined exits | Better capital rotation |

| Multi-platform security checks | Guards against outdated APIs | Lower operational risk |

For many investors, this move toward holistic tracking has already boosted not just accuracy, but confidence – the calm assurance of knowing exactly where every coin sits and how it performs.“Organization isn’t about control; it’s about freedom from confusion,” one portfolio manager aptly noted.

In the years ahead, the line between crypto and traditional investing will blur even further. The trackers we rely on will become the invisible framework holding digital wealth together – a quiet layer of logic beneath the noise of the markets.